Nuclear News #003

Denison trial ISR update. Cameco conference call. France seeks secure uranium supplies.

Denison’s successful ISR trial project

Denison Mines Corp. announced on Thursday, November 2, the successful completion of the recovered solution management phase of the Phoenix in-situ recovery (ISR) Feasibility Field Test (FFT) at their Wheeler River project.

Key take-aways:

The FFT involved recovery of 14,000 lbs of U3O8 dissolved in solution generated during the leaching and neutralization phases in late 2022. In tonnes of uranium (tU) that is roughly 5.4tU.

The solution was recovered with 99.99% efficiency, which validates the processing designs and assumptions for the future Phoenix processing plant. All the data gathered during this FFT will be valuable going forward for the company. We feel this news release from Denison is a further promising development form a promising company. We will continue to watch Denison closely.

With any mining operation – especially involving uranium – environmental safety is a top priority for all involved. The recent press release contained good news in this regard too. The FFT observed no treated effluent anywhere outside of the intended injection area. All solutions used and injected into the subsurface during this FFT stayed exactly where they were supposed to.

The promising news and recovery numbers contained in this press release, suggest ISR will be an efficient method to implement on the Wheeler River project. These latest developments further de-risk Wheeler River in our opinion.

Denison effectively owns 95% of the Wheeler River project. It owns 90% of the project outright, with JCU (Canada) Exploration Company owning the other 10%. However, since Denison owns 50% of JCU, which they announced August 03, 2021, they therefore own a further 5% of the project (50% of 10%), effectively owning 95% of Wheeler River.

We do own shares in Denison, and have done since February 2021. We plan to accumulate in small tranches going forward.

Cameco conference call

Cameco held a conference call on Oct 31st, and released their unaudited financial statements for the 9-months up to September 2023. All strong. Yet, one of the most interesting parts of the conference call was the Q&A towards the end.

The call mentioned that Cameco has contingency plans in place, in the event deliveries from their Inkai JV with Kazatomprom - which use the Trans-Caspian International Transport Route - are delayed or disrupted. (See previous publication, “Kazatomprom – 2025 Guidance”, for more details regarding the Trans-Caspian Route and its risks).

While Cameco stated they have a contingency plan in place for such an event, it did not provide details on what their contingency plan actually is.

Dividend Announcement

The board of directors also declared a 2023 annual dividend of $0.12 per common share, which is payable on December 15, 2023, to shareholders of record on November 30, 2023.

Conference Call Q&A

During the conference call, some of Cameco’s management team took questions. One of the best questions – and subsequent most-interesting answer – are below:

Q: “It seems like you guys have plans to buy around 13 million pounds of U3O8 this year, but it seems like so far, you've bought five million. Is the plan to buy roughly eight million on the spot market? Could you just give us an update there? Thanks for the questions. Congrats on the results.”

A: “…production is an important source of it. We carry an inventory to deal with any production shortfalls, like we have today. We will make purchases in the near-term on the spot market for immediate delivery. We will occasionally buy on the forward curve for delivery out into the future, and we can take delivery of that material sooner if we need it. We have other tools in the toolbox, including, as Tim said, folks have a lot of material parked in our facilities. In some cases, we have the ability to borrow it.”

Acquisition Approved

And finally on Cameco, they have received all the necessary approvals to acquire Westinghouse Electric. They stated the acquisition is set to be completed around November 7, 2023. Cameco plans to pay for its part of the acquisition using a $600-million loan and cash it already has, without using a $280-million commitment they had previously secured.

Macron in Kazakhstan

French president Emmanuel Macron recently visited Kazakhstan and Uzbekistan, which are France’s largest and third-largest suppliers of their uranium, respectively. These visits seem to be aimed securing future uranium supplies. France does after all, produce 70% of its electricity from its large nuclear fleet. It needs secure supplies.

France may be hoping to expand its influence in the region as it sees China now eyeing up Kazakhstan’s rich uranium supplies. Made clear in the light of the recent large deals penned with China by Kazatomprom.

This trip comes at a time when 15% of France’s uranium supplies are in jeopardy due to the military junta that took over Niger in a coup back in late July, 2023. Questions remain whether or not Niger will remain a reliable source of uranium.

ETFs

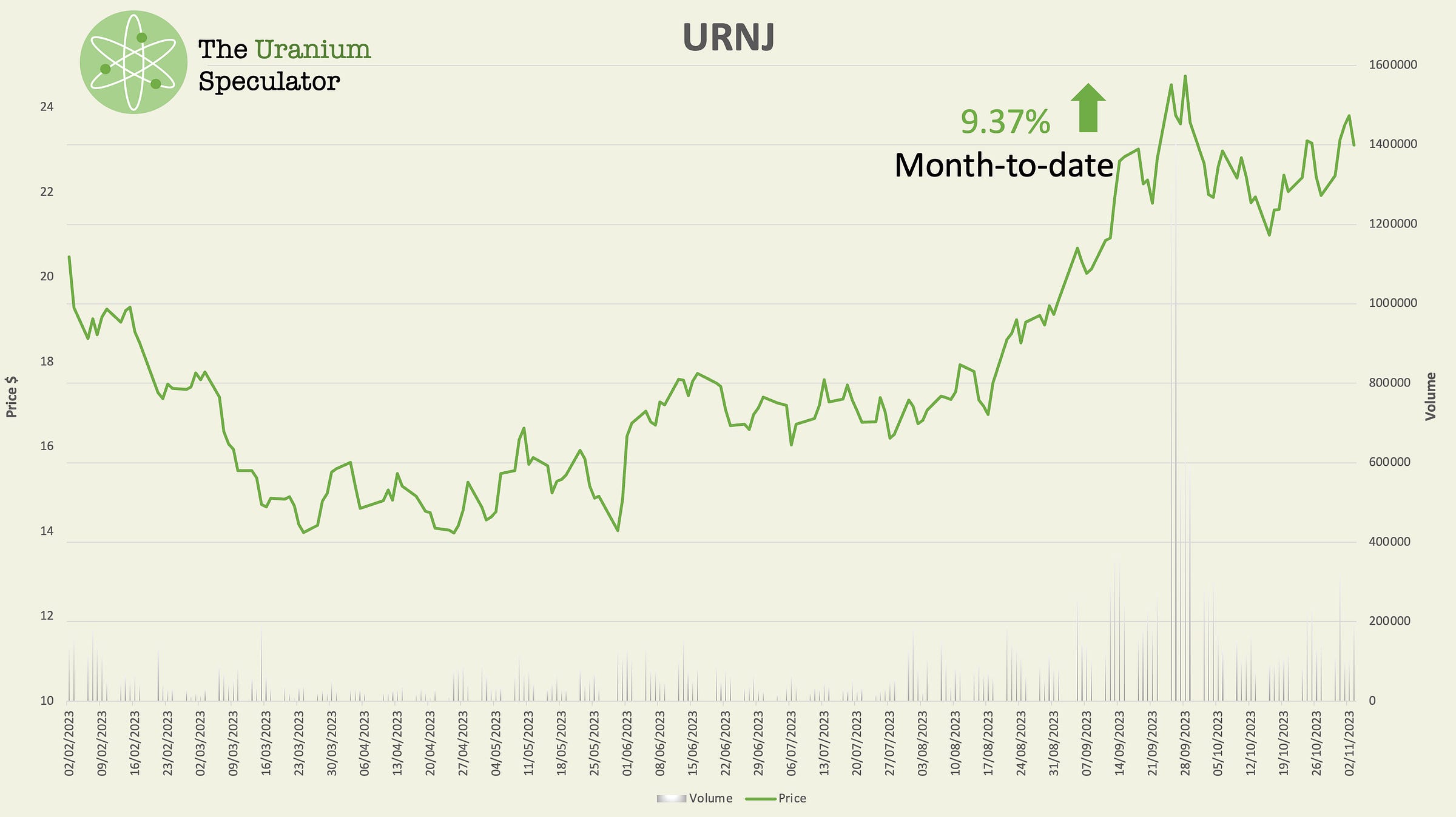

Finally, to the ETF’s. They have all had a fairly strong month. Sprott’s URNM & URNJ are both up 8.5% and 9.34%, respectively, month-to-date. While Global X’s URA is up 9.29% month-to-date. All three ETFs saw strong inflows during the first weeks of October, likely a result of the quick turnaround we saw in the spot uranium price. Going from $72.50/lbs to $69/lbs. Only for it rebound quickly to a 15-year high of $74.15/lbs. Likely on very little volume in the spot market too – possibly as little 200,000 to 300,000/lbs of U3O8.

ETF charts below:

The week started fairly strong for the uranium equities, but saw a little weakness towards the end of last week. But generally, most equities ended slightly up on the week.

Also saw a slight decline in the spot price of U3O8 towards the end of the week. Some of the uranium equities are trading up in ‘after hours’, but not significantly. Will keep an eye on developments in the space and report back to all subscribers in the coming weeks.

Warm regards,

The Uranium Speculator